QBR – Crucial for Success

A QBR (Quarterly Business Review) allows you to boost your image in the eyes of customers by demonstrating the success they can achieve with your service.

What is a QBR?

QBRs are quick checks of KPIs and review of the relationship with the customer overall. The QBRs are basically touchpoint meetings with your customers on a quarterly basis to review how well you’re backing their success. The intention of the meeting is to review the impact of your product on the customer’s business as well as discuss future goals.

Business reviews are part of the most undervalued tools in a services company’s resources, however, QBRs focus on new ways to help customers achieve their goals, expose risks and opportunities you’re equipped to address and ensure customer leadership sees you as a critical part of their growth strategies. That’s the reason these meeting are so important!

These meetings ensure customer satisfaction or check the possibility of improvements keeping activities on schedule, at or under budget achieve the agreed KPIs. It’s up to you and your business to demonstrate how you can add more value so that the customer is willing to continue the partnership.

Main reason for the existence of these reviews are that being a vendor does not mean being only a service provider but being a partner to your clients’ business success. As a partner you can increase your customers’ loyalty and expand the relationship you have by insisting on having QBRs meetings.

Which content should a QBR meeting include?

A QBR usually discusses the progress made in the past 90 days, review product usage and performance. Additionally, the discussion should include strategic obstacles and challenges and a definition of a 90-days action plan in place for the next quarter.

In general, it should include the strategic goals of your customer, yours and the mutual strategic goals you both share. Goals should be specific, defined by measures, relevant to achieve and defined by schedule.

What are the expected results of this review?

The result is a plan of how you and your client intent to achieve the strategic goals defined. Outline open items that will drive the business toward its goal. Mark follow-up items that ascend from the business review. Maybe you need to find a new platform or research for new technologies. Make sure to write those items down to ensure everyone is on the same page.

In case there are unresolved issues that come up during the QBR discussions make sure to check these issues and come back to the client with some clarifications. If the customer has made changes in its business objectives, ensure you make the appropriate preparations to address those new objectives.

As a service company you would like keeping customers satisfied to earn their loyalty so checking regularly that you are meeting their expectations is crucial to your success.

What are the advantages of having QBRs?

Maintaining positive and strong client relationships can lead to upselling opportunities and ensure smoother operations. It is just as important as the customer success of the product or service you’re selling. A QBR meeting ensures that you are able to stay in touch with the client and prevent losing touch with their business goals. Additionally, it is an opportunity to meet and get to know key personnel within the client’s company.

QBRs enable you to pinpoint negative customer feedback and prevent problems before the customer is dissatisfied and comes to a breaking point.

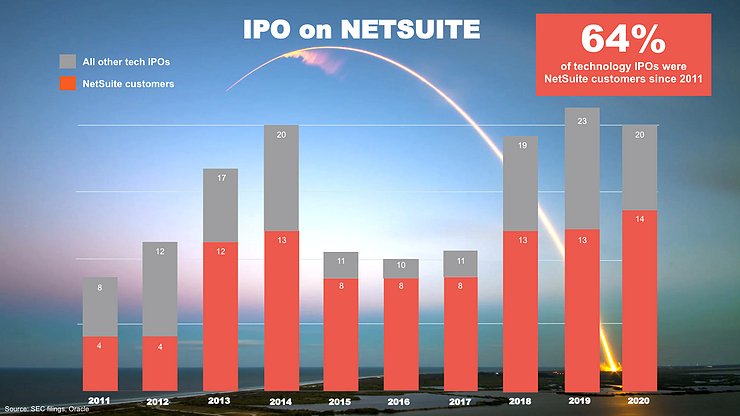

The QBR is a great opportunity to show the customer how much value they’re getting from your product at scale. While individual success stories are important, you should show them the impact to their organization as a whole. This requires the use of metrics, survey data, and whatever other available KPIs. Such data is available if you have CRM software in use such as Salesforce and an ERP system as NetSuite. Customer satisfaction is a priority for most businesses, as it leads to long-lasting client relationships.

What are in-house QBRs meeting?

Having QBR meeting of sales managers with sales reps are most valuable for promoting the business. These meetings should be thought as a potential forum where reps and sales management line up on region plans, and reps can assess their ability to achieve those plans.

First there should be a review of last quarter performance; the deals that were closed, what are the reasons for the deals we lost, how can we improve those setbacks and what are the deals we aim to achieve in the next coming quarter.

Additionally, QBR is the right time to review pipeline projects and assess their probability and risks. As a result of this forecast discussion, an action plan for the next quarter sales goals should be agreed on. Even if the target list becomes shorter, it’s better to have a shorter but more realistic goals list than a very long one with lower chance to be achieved.

re it is necessary to adjust the value of cryptocurrencies before paying. The price of Bitcoin in 2015 was relatively low at $170 a unit, but it has increased rigorously in the past couple of years reaching over $28,000 a unit by the end of 2020.

re it is necessary to adjust the value of cryptocurrencies before paying. The price of Bitcoin in 2015 was relatively low at $170 a unit, but it has increased rigorously in the past couple of years reaching over $28,000 a unit by the end of 2020.